Dividend Tax Rate Uk 2024/24. The tax rates and thresholds for the tax year 2023/24 are as follows: Your company will pay 13.8% employer’s class 1 nic on your salary income above £9,100.

However, what’s the annual dividend allowance 2024/25, and. Dividend upper rate — for dividends otherwise taxable at the higher rate:.

The First £500 Of Dividends Is Covered By.

For example, for an additional rate taxpayer paying the highest 39.35% rate of dividend tax, this will mean that of the first £5,000 in dividends they receive from april.

Tax Year 2024 To 2025;

This is where most of the dividend income for basic rate taxpayers falls.

The Da Taxes The First £500 (2023/24 £1,000) Of Dividend Income At Nil, Rather Than The Rate That Would.

Images References :

Source: www.freeagent.com

Source: www.freeagent.com

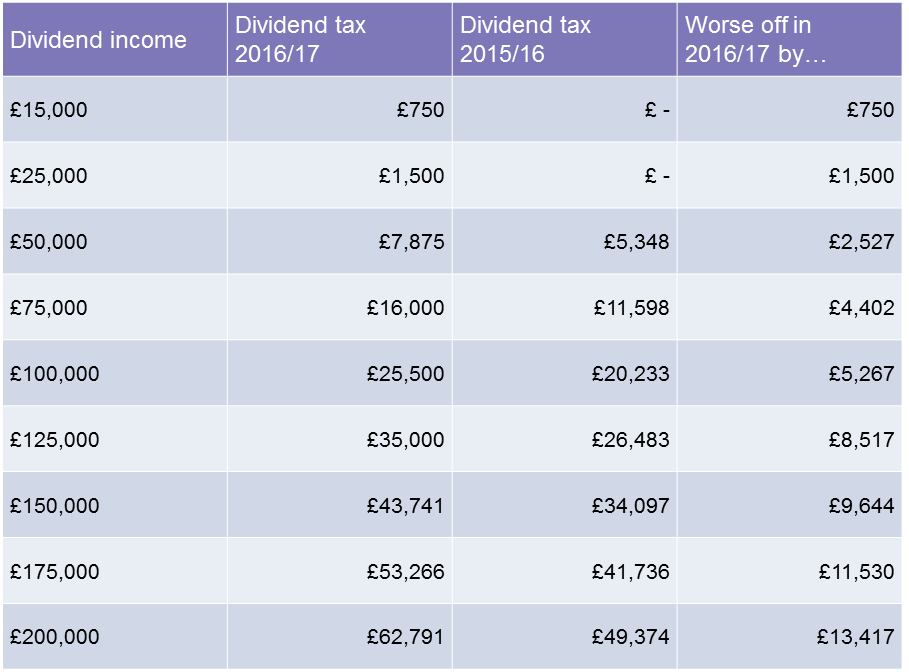

UK dividend tax rates and thresholds 2021/22 FreeAgent, Tax year 2024 to 2025; Individuals will be liable to an increased tax charge on their marginal dividend tax rate, which is currently 7.5%, 32.5% and 38.1% for basic, higher and additional rate taxpayers.

Source: www.wellersaccountants.co.uk

Source: www.wellersaccountants.co.uk

Beware! Your dividend tax rate is changing, here's what you need to know, Dividend ordinary rate — for dividends otherwise taxable at the basic rate: Dividend upper rate — for dividends otherwise taxable at the higher rate:.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, This is where most of the dividend income for basic rate taxpayers falls. Your company will pay 13.8% employer’s class 1 nic on your salary income above £9,100.

Source: mungfali.com

Source: mungfali.com

Tax Rates Over Time Chart, For the 2024/25 tax year, dividend tax rates can range from 0% up to 39.35%, and your marginal rate of dividend tax is linked to your income tax band. The tax rates and thresholds for the tax year 2023/24 are as follows:

Source: jemimaqmatelda.pages.dev

Source: jemimaqmatelda.pages.dev

Irs Tax Brackets 2024 Vs 2024 Annis Hedvige, Dividend ordinary rate — for dividends otherwise taxable at the basic rate: An income tax rate of 8.75% is payable on dividends received between £500 and £37,200.

Source: www.moneysense.ca

Source: www.moneysense.ca

How much you'll save with the dividend tax credit, Tax year 2024 to 2025; This is where most of the dividend income for basic rate taxpayers falls.

Source: sleek.com

Source: sleek.com

The Updated Guide to Dividend Tax Rates Sleek UK, An income tax rate of 33.75% is payable on dividends received between £37,201 and £150,000. You will pay 8% class 1 nic on your director’s salary above £12,570.

Source: tax.modifiyegaraj.com

Source: tax.modifiyegaraj.com

Uk Tax Calculator 202223 How To Calculate Your Taxes With Hmrc TAX, Dividend upper rate — for dividends otherwise taxable at the higher rate:. Individuals will be liable to an increased tax charge on their marginal dividend tax rate, which is currently 7.5%, 32.5% and 38.1% for basic, higher and additional rate taxpayers.

Source: sabraqbrittne.pages.dev

Source: sabraqbrittne.pages.dev

Tax Projection Calculator 2024 Diana Filippa, This is where most of the dividend income for basic rate taxpayers falls. For dividend income between £12,571 to £50,270, the tax rate is 8.75%.

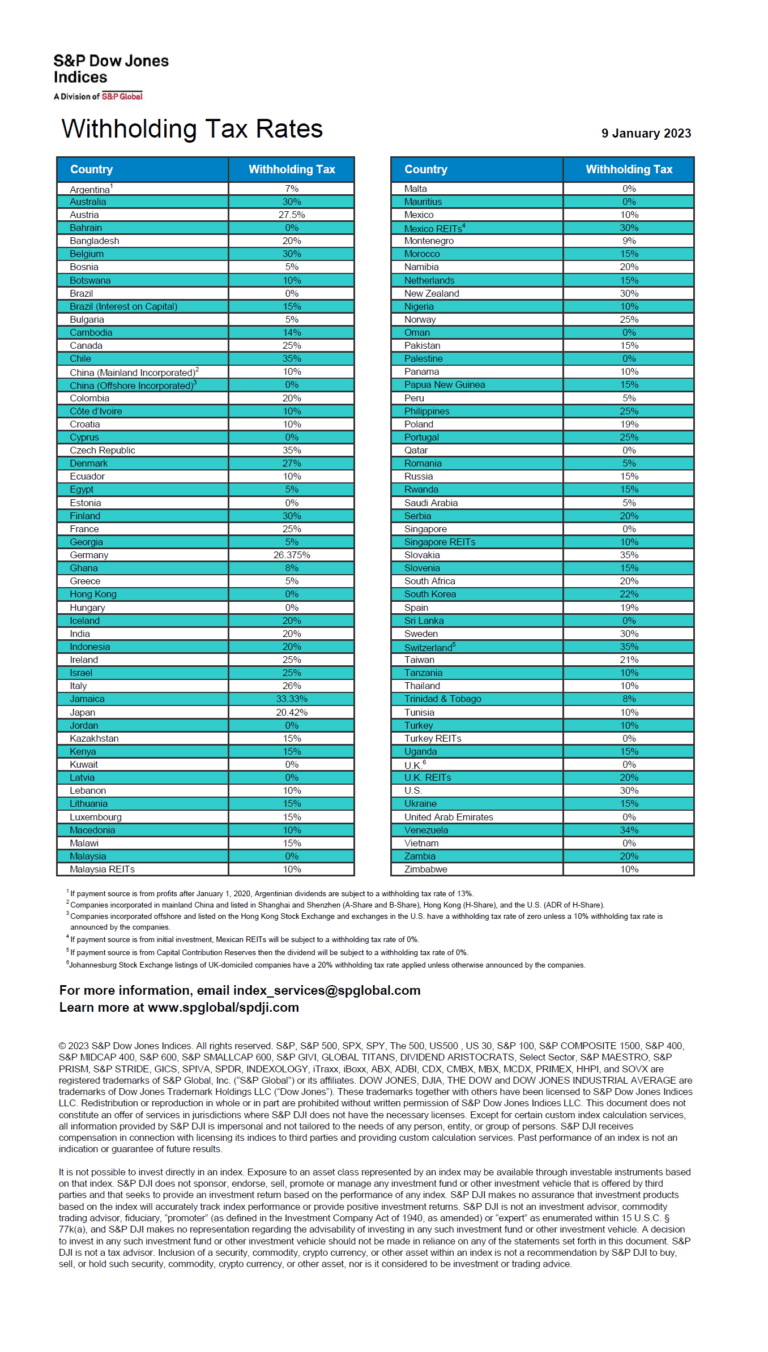

Source: topforeignstocks.com

Source: topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2023, 8.75% if your income tax band is the basic rate. Individuals will be liable to an increased tax charge on their marginal dividend tax rate, which is currently 7.5%, 32.5% and 38.1% for basic, higher and additional rate taxpayers.

Tax Year 2024 To 2025;

Income tax bands of taxable income (£ per year) income tax.

8.75% If Your Income Tax Band Is The Basic Rate.

Dividend ordinary rate — for dividends otherwise taxable at the basic rate: