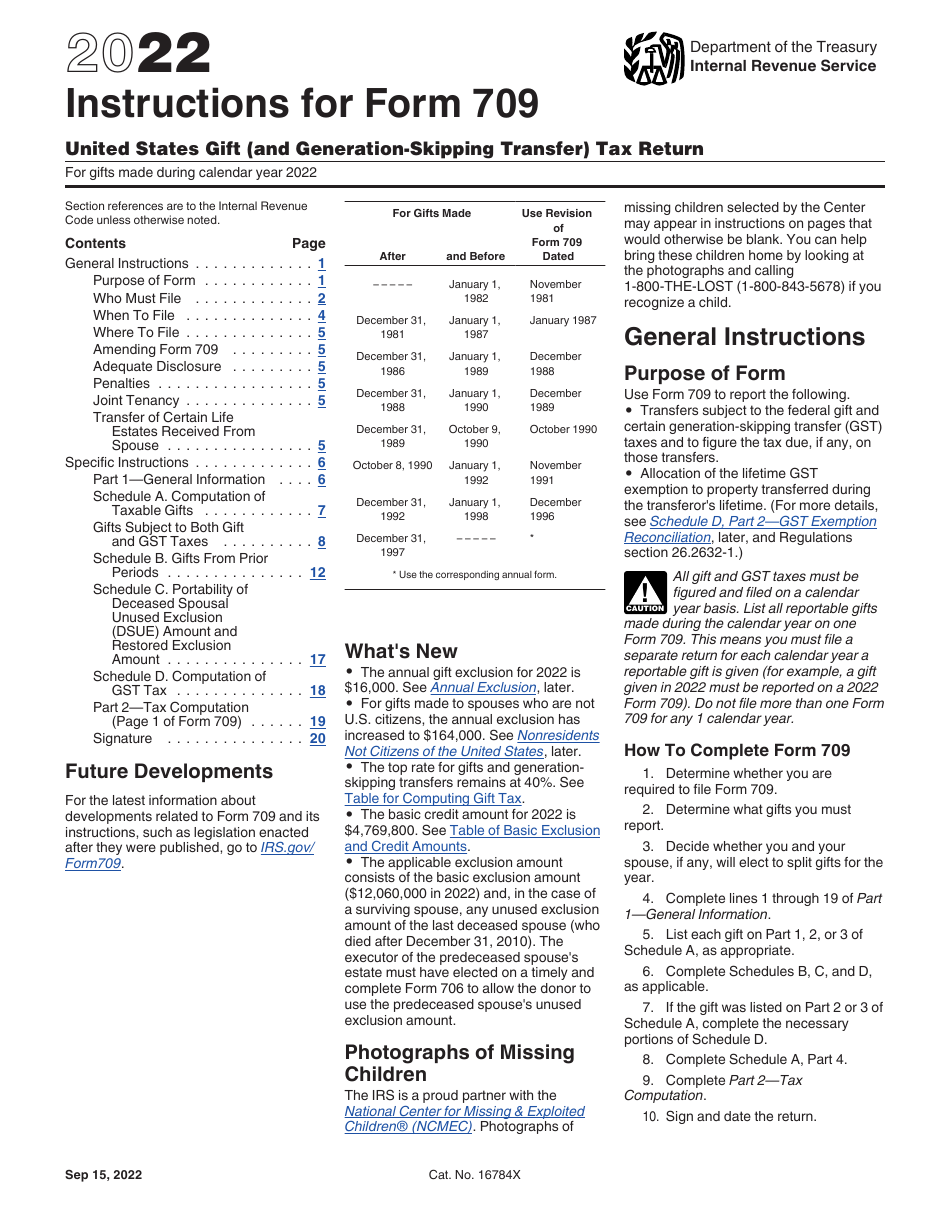

Irs Form 709 For 2024. 2 filing foreign gift form 709. For the latest information about developments related to form 709 and its instructions, such as.

Crypto gifts are generally not taxable, and gifts up to $18,000 in 2024 don’t require filing form 709,. Page last reviewed or updated:

The Gift Tax Is A Federal Tax On Transfers Of Money Or Property To Other People Who Are Getting Nothing (Or Less Than Full Value) In.

Gift tax return for expats.

The Ultimate Guide To Form 709:

You always owed federal income tax on interest from savings accounts.

But This Year, The Irs Has Stuck To Their Regular.

Images References :

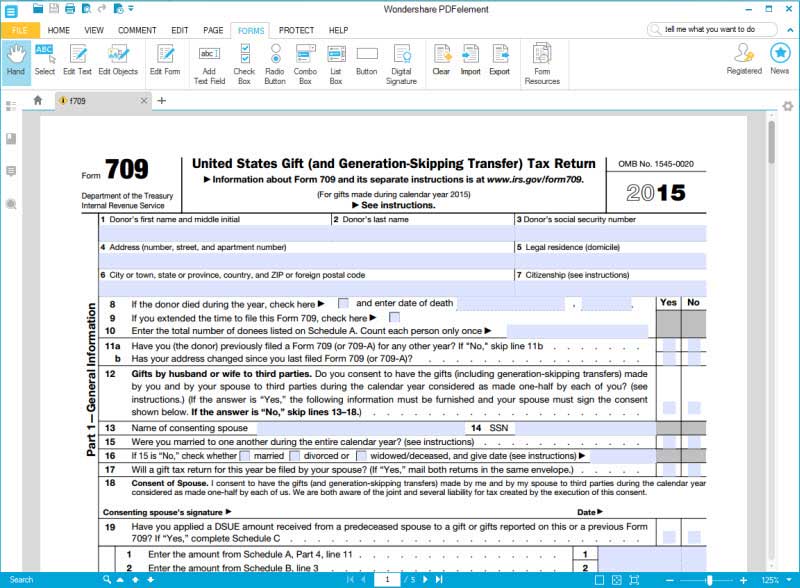

![Guía para Rellenar el Formulario 709 del IRS [Actualizada 2024]](https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-709-part2.png) Source: pdf.wondershare.es

Source: pdf.wondershare.es

Guía para Rellenar el Formulario 709 del IRS [Actualizada 2024], 2 filing foreign gift form 709. 1 what is irs form 709.

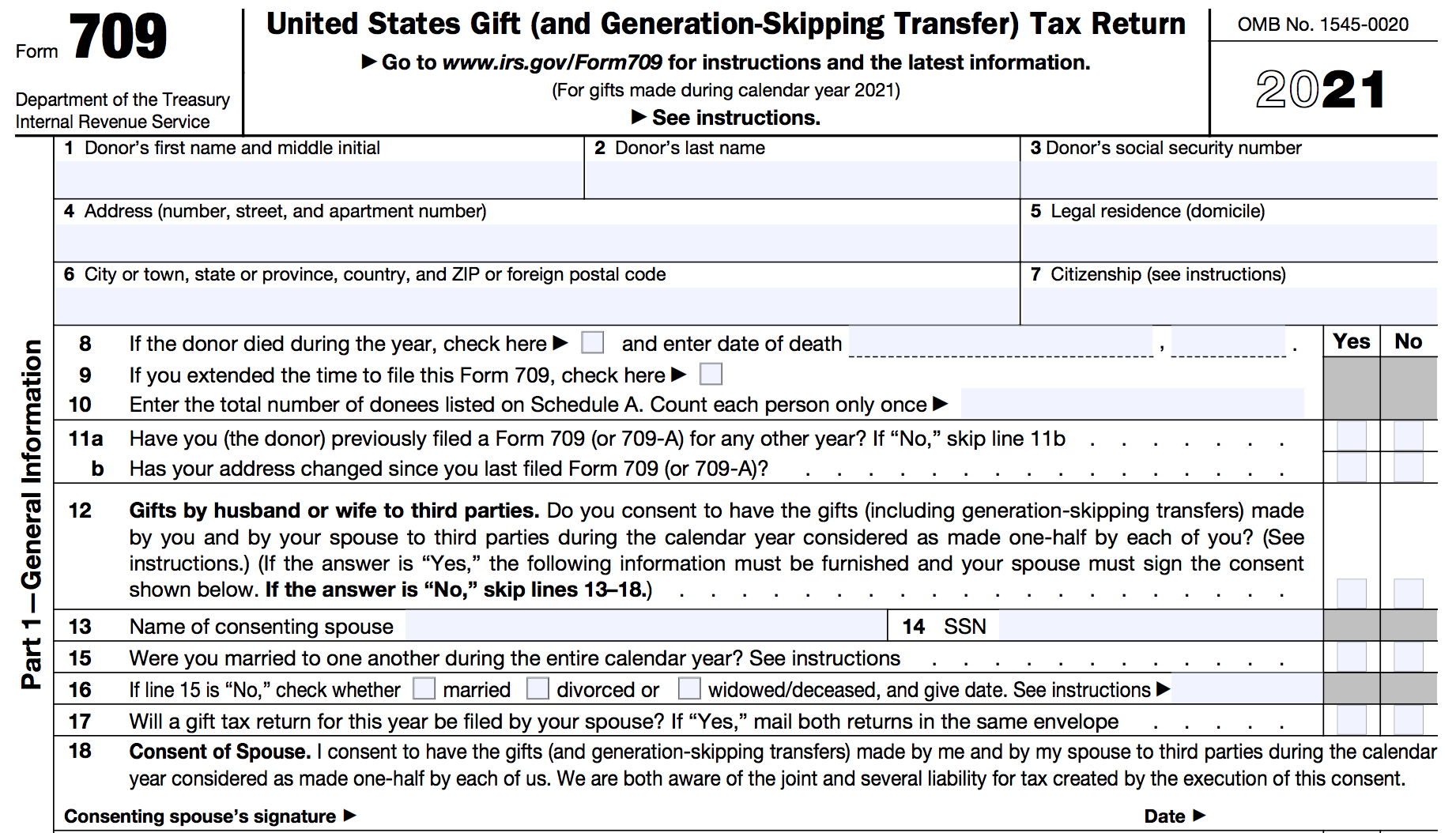

Source: brighttax.com

Source: brighttax.com

Form 709 and Gift Tax for Expats What to Know Bright!Tax Expat Tax, For tax year 2023 (taxes filed in 2024), you could have given any number of people up to $17,000 each without. The annual exclusion limit is the amount of money or value of gifts you can give as american expatriates in a.

Source: smartasset.com

Source: smartasset.com

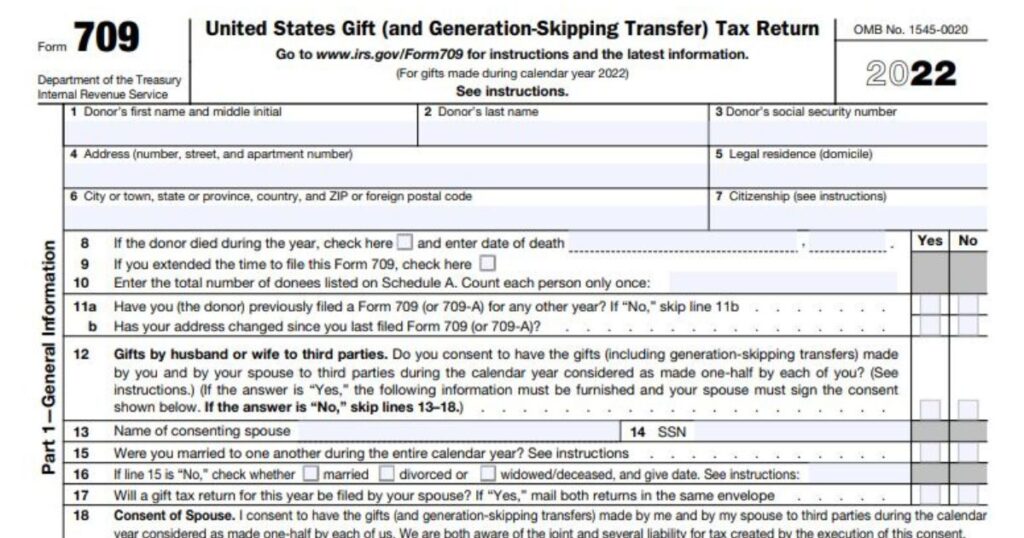

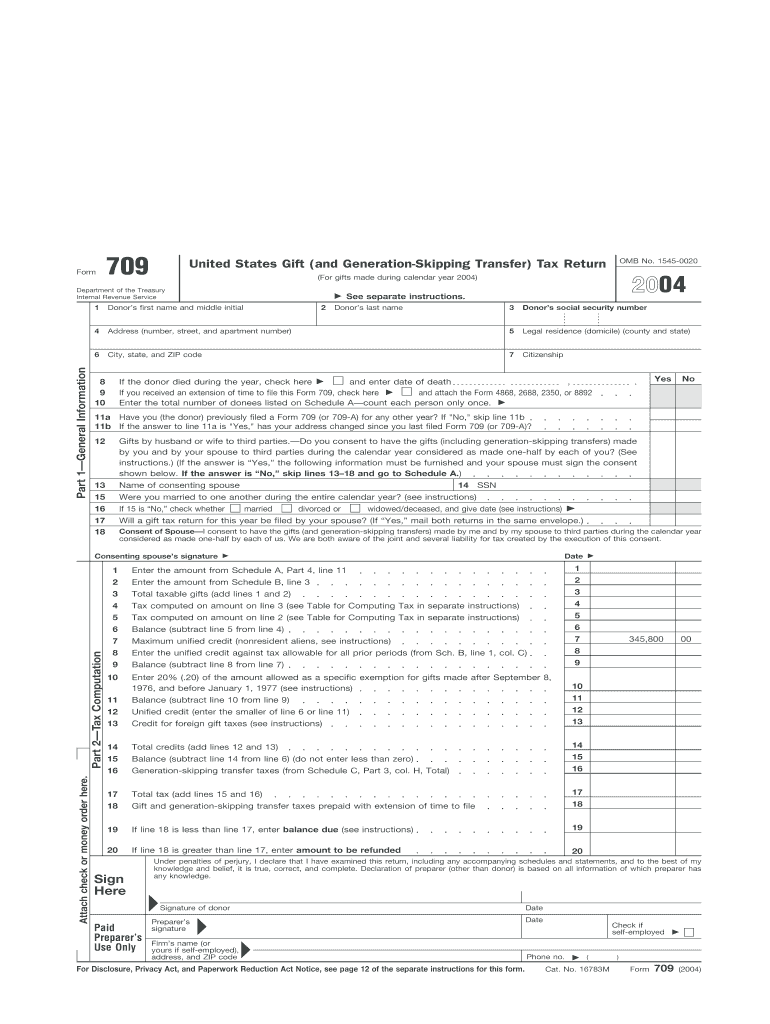

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax, First, complete the general information section. How to fill out form 709.

Source: www.templateroller.com

Source: www.templateroller.com

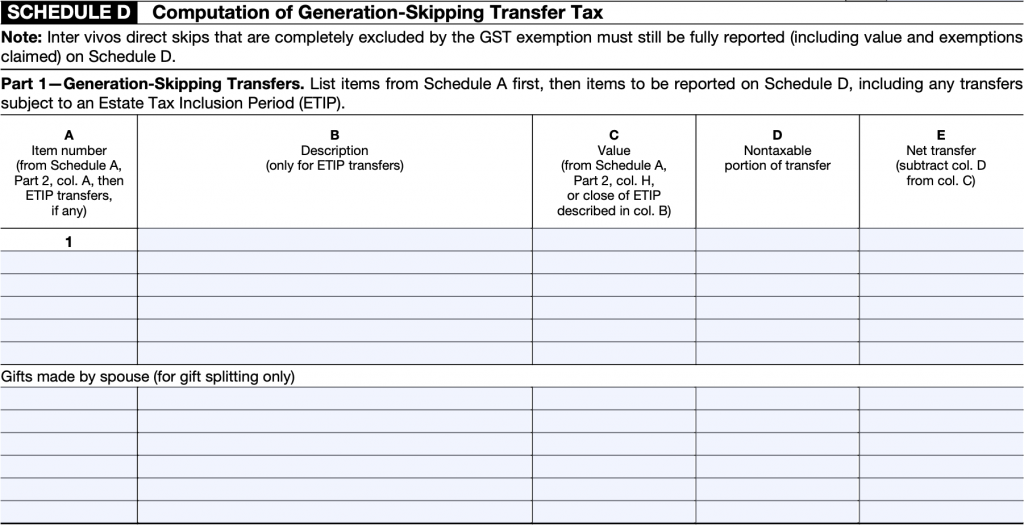

Download Instructions for IRS Form 709 United States Gift (And, Gift tax, you must file a gift tax return (form 709 united states. You always owed federal income tax on interest from savings accounts.

Source: mungfali.com

Source: mungfali.com

Completed Form 709 Example Sample, Basics of gift tax returns understanding the gift tax return form (form 709) calculating the gift tax conclusion gift tax return faqs. For additional information, review form 709 and its instructions.

Source: mungfali.com

Source: mungfali.com

Federal Gift Tax Form 709 Gift Ftempo ED4, A variation of this seemingly innocuous question appears at the top of forms 1040, individual. For the latest information about developments related to form 709 and its instructions, such as.

Source: panglimaword.co

Source: panglimaword.co

Irs Form 709 Gift Tax Exclusion Panglimaword.co, For tax year 2023 (taxes filed in 2024), you could have given any number of people up to $17,000 each without. First, complete the general information section.

Source: pdf.wondershare.com

Source: pdf.wondershare.com

Instructions for How to Fill in IRS Form 709, But as dehaan points out, what makes this. For the latest information about developments related to form 709 and its instructions, such as.

![Guía para Rellenar el Formulario 709 del IRS [Actualizada 2024]](https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-709-part1.png) Source: pdf.wondershare.es

Source: pdf.wondershare.es

Guía para Rellenar el Formulario 709 del IRS [Actualizada 2024], The gift tax return is irs form 709. Key terms and items to note for completing gift tax returns.

Source: smartasset.com

Source: smartasset.com

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax, Below are some of the more common questions and answers about gift tax issues. Basics of gift tax returns understanding the gift tax return form (form 709) calculating the gift tax conclusion gift tax return faqs.

The Annual &Amp; Lifetime Gift Tax Exclusions.

You always owed federal income tax on interest from savings accounts.

The Gift Tax Return Is Irs Form 709.

3 not everyone giving gifts must file a form 709.